GST Payment Understanding the GST (Goods and Services Tax) payment process is crucial for businesses and individuals alike in India. Whether you’re a small business owner, a startup founder, or a tax consultant, timely and correct GST payment is essential to stay compliant and avoid hefty penalties. In this article, we’ll walk you through the complete GST payment process, its history, due dates, challan generation, online payment procedures, and more.

A Brief History of GST in India

The Goods and Services Tax (GST) was launched on July 1, 2017, to unify India’s complex tax structure. It replaced multiple indirect taxes like VAT, service tax, and excise duty. GST created a common national market by ensuring one tax on goods and services across the country. Since its implementation, the government has made the payment and filing systems largely digital, simplifying the tax compliance process.

What Is GST Payment?

GST payment refers to the remittance of tax collected on goods and services supplied or consumed. It includes:

-

CGST (Central GST)

-

SGST (State GST)

-

IGST (Integrated GST)

-

CESS (Compensation Cess, where applicable)

Businesses must deposit these taxes monthly or quarterly based on their registration type and turnover.

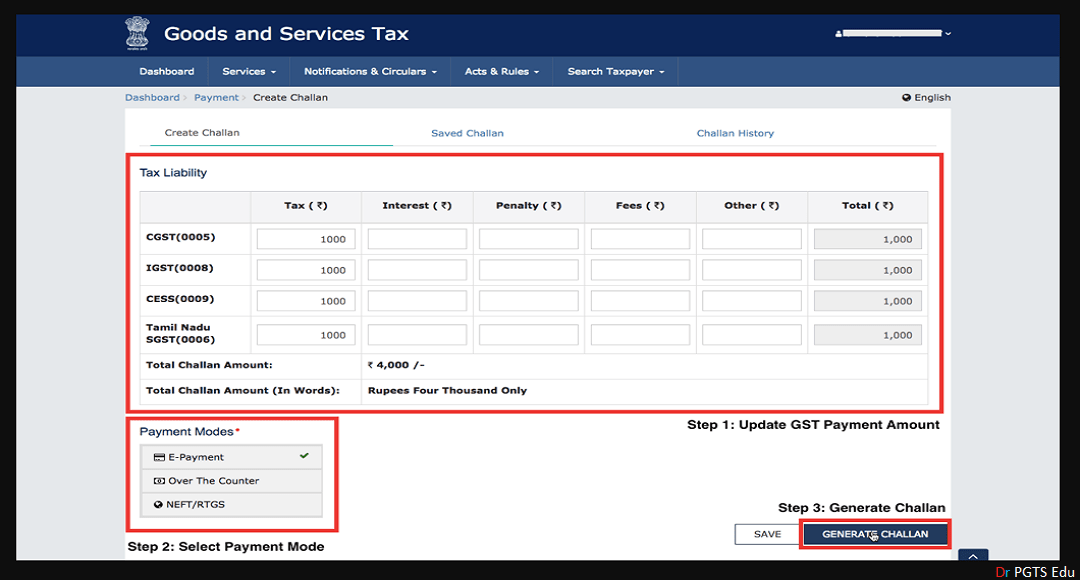

GST Payment Procedure: Step-by-Step Guide

Here’s how you can make your GST payment online via the GST portal:

Step 1: Generate GST Challan

-

Visit official Website

-

Go to Services > Payments > Create Challan

-

Enter your GSTIN or Temporary ID

-

Choose the tax type (CGST, SGST, IGST, CESS)

-

Enter the amount and proceed

Step 2: Choose Mode of Payment

You can pay through:

-

Internet banking

-

NEFT/RTGS

-

Over-the-counter (OTC) via authorized banks

-

UPI or debit card in some cases

Step 3: Make the Payment

-

Select your preferred payment mode

-

Complete the transaction

-

Receive a Challan Receipt (CPIN) and Payment Reference Number (PRN) for your records

Step 4: File the Return

Once the payment is successful, you must file the appropriate return form (e.g., GSTR-3B) by the due date. The tax paid gets reflected in the Electronic Cash Ledger.

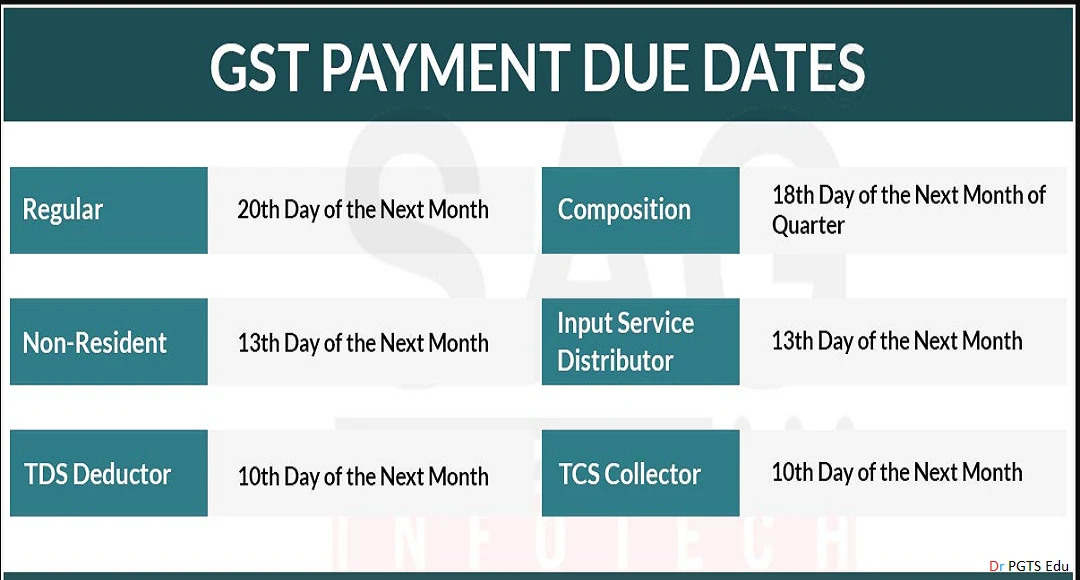

GST Payment Due Dates

Here’s a handy table of important due dates:

| GST Return Type | Frequency | Due Date | Who Should File? |

|---|---|---|---|

| GSTR-3B | Monthly | 20th of next month | All regular registered taxpayers |

| GSTR-1 | Monthly/Quarterly | 11th of next month / End of quarter | Suppliers of goods and services |

| CMP-08 | Quarterly | 18th of the month after quarter | Composition scheme taxpayers |

Note: Dates may vary for special states and specific turnover brackets.

How to Check GST Payment Status

To ensure your GST payment has been processed:

-

Log in to the GST portal

-

Navigate to Services > Payments > Track Payment Status

-

Enter your CPIN (Challan Identification Number)

-

View the status (Success, Pending, or Failed)

GST Payment Receipts

Upon successful payment, a GST receipt (in the form of Challan Form GST PMT-06) is generated. It contains:

-

CPIN

-

GSTIN

-

Amount Paid

-

Payment Date

-

Mode of Payment

-

Bank Reference Number

Keep this document for record-keeping and audit purposes.

Total GST Payment in India (Annual Overview)

India collects substantial revenue through GST. Here’s a brief snapshot of collections over the years:

| Financial Year | Total GST Collection (INR Crores) |

|---|---|

| 2017–18 | ₹7.19 lakh crore |

| 2018–19 | ₹11.77 lakh crore |

| 2019–20 | ₹12.22 lakh crore |

| 2020–21 | ₹11.36 lakh crore |

| 2021–22 | ₹14.83 lakh crore |

| 2022–23 | ₹18.10 lakh crore |

| 2023–24 | ₹20.14 lakh crore |

These figures highlight how GST has become a backbone of India’s tax system.

Common Penalties for Late GST Payment

If you delay or miss your GST payment:

Interest: 18% per annum on the unpaid amount

Late Fees: ₹50 per day (₹25 CGST + ₹25 SGST), capped at ₹5,000

Loss of Input Tax Credit (ITC) eligibility

Being aware of deadlines and procedures can help you avoid these penalties.

GST payment is more than a legal obligation—it’s a vital part of a business’s financial ecosystem. With streamlined digital processes, anyone can complete their GST payments online with minimal hassle. Just remember to generate the challan, make timely payments, and track your status. Staying informed is the best way to stay penalty-free and compliant.

Read also: Income tax aggregation in 2025 what you need to know to maximize your refund